- A survey of customs administrative penalty cases in Shanghai (2018)

Please click and refer to the Chinese version:

2018年度上海海关行政处罚案件透视 - 企业在哪些方面需加强贸易合规措施?

Customs and Trade Compliance

Deming Zhao | Mingming Dai | Yiqi Du

Summary

We surveyed 672 customs administrative penalty cases issued by Shanghai Customs and its subordinate customs in 2018, and our findings are as follow:

1. Customs value, tariff code and import/export license declarations were the most frequent reasons for the customs penalty;

2. Most cases happened in machinery, equipment, chemistry, iron and steel industries;

3. Company must pay more attention to import/export license and certificate of origin management;

4. Some cases were voluntarily disclosed by the companies themselves, resulting in lighter penalties.

Accordingly, there are high risks of non-compliance and customs investigations with respect to declarations of customs value, tariff code and licenses of goods imported into or exported from China. Customs risks seem higher to the machinery, equipment, chemistry, iron and steel industries.

It was recommended that companies to conduct trade compliance health check to determine whether the past three year declarations were truthful and lawful relevant to customs value, tariff code, trade licensing requirement and country of origin, and timely stop irregular practices if any and voluntarily disclose to Chinese customs of incorrect declarations to take advantage of leniencies available in the voluntary disclosure scheme, to avoid severe administrative or criminal liabilities.

In 2018, Shanghai customs published 672 administrative penalty cases online regarding smuggling and other violation act (excluding intellectual property violation act). In this regard we analysed as follows.

I. Types of violations

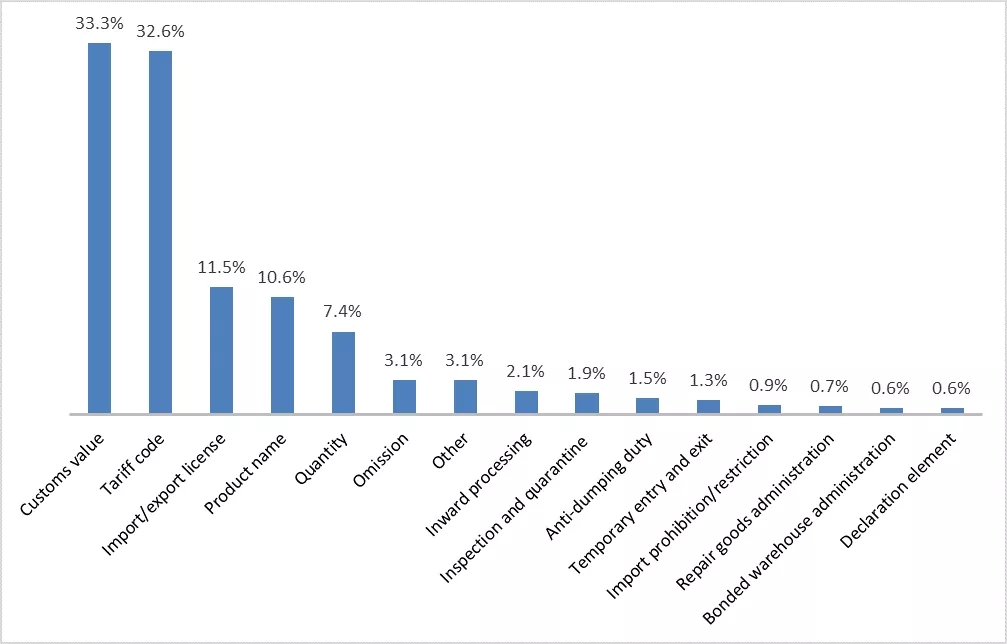

Chart 1:Types of violations

(multiple violations may happen in one case)

As shown above, incorrect customs value, incorrect tariff code and violation of import/export license requirements are the top 3 reasons for the customs penalty. More efforts are desirable in health checks on customs value, tariff code and goods license of import and export or bonded transactions.

(1) Incorrect customs value

Incorrect customs value is the top one reason for customs penalties, accounting for 33.3% of surveyed cases. It includes errors in transactional value, incoterm, freight, storage fee, insurance premium, packaging fee, currency and so forth.

Incorrect declaration of customs value may result in under-paid/over-refunded duties or taxes. Pursuant to the Implementing Regulations of the Customs of PRC on Administrative Penalties, if the incorrect declaration “affects the state tax collection, a penalty of 30% up to 2 times the tax under-paid shall be imposed”; if it “affects the state foreign exchange or export tax refund management, a penalty of 10% up to 50% the declared price shall be imposed.”

(2) Incorrect tariff code

Incorrect tariff code is the top 2 reason of customs penalty, making 32.6% of the surveyed cases.

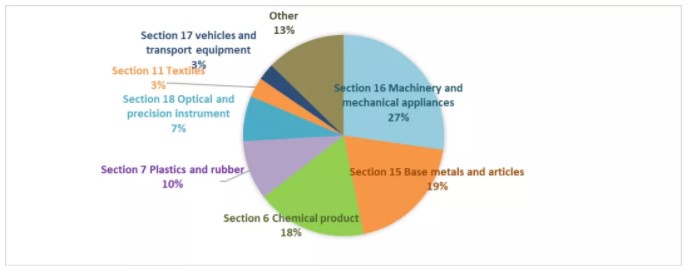

Of all goods with incorrect tariff code, 27% were machinery and equipment goods classified in Section 16 under Import and Export Tariff Schedule (2018). This Section involves two Chapters: Chapter 84(machinery and mechanical appliances) and Chapter 85 (electrical machinery and equipment and parts thereof). The tariff code classification rules in these 2 chapters are complex and technical, resulting in many tariff code errors on the part of the company.

19% goods with incorrect tariff code were base metal goods classified in Section 15. It mostly happened on goods in Chapter 72 (iron and steel) and Chapter 73(articles of iron and steel). Iron and steel companies need to pay more attention to tariff codes.

18% goods with incorrect tariff code were chemical products classified in Section 6. It mostly happened on goods in Chapter 38 (miscellaneous chemical products). Chemical products usually have complex composition and the tariff code classification rules are sometimes vague. Chemical companies need to enhance goods classification management.

Chart 2: Incorrect tariff code

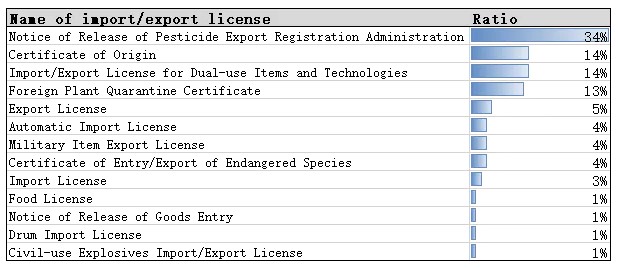

(3) Violation of import/export license requirements

In the total 672 cases, 11% were caused by failure to apply, declare or submit import/export license correctly. The most frequent license for the customs penalty is the Release Notice of Pesticide Export Registration Administration, accounted for 34%. This may be due to the unawareness of some chemical companies that their products (e.g. biocides) were pesticides related.

The other most frequent subjects for customs penalty was Certificate of Origin, Import/Export License for Dual-use Items and Technologies, Foreign Plant Quarantine Certificate and so forth. It is noticeable that country of origin is closely related to the extra tariff during China-US trade war and the preferential duty in free trade agreements. There have been cases of forging the country of origin in order to get a lower import tariff rate. Cases related to Import/Export License for Dual-use Items and Technologies shows that the export control has come to one of the focus of customs supervision.

Table 1: Cases of violation of import/export license requirements

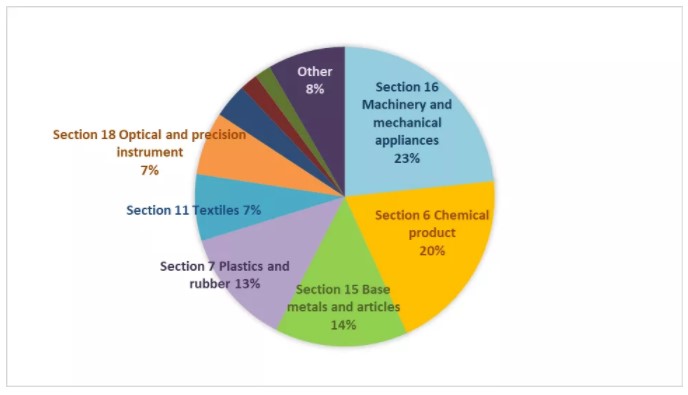

II. Sectorial manifestations

Out of the surveyed cases, three industries ranked high implicated in customs penalties. They are machinery industry, chemical industry and base metal (iron/steel) industry. These industries are expected to strengthen the trade compliance measures.

Chart 3: Industry survey

III. Penalty amount

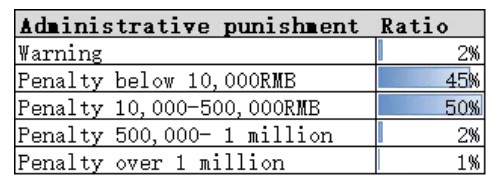

Within the 672 cases, the customs penalties vary from warning to a penalty that can be up to millions. The largest penalty amount imposed was over 4 million RMB. We can see from Table 2 that 97% cases resulted in such penalties either as warning or a penalty below 500,000 RMB.

In case the company voluntarily self-disclose its violations and is imposed of penalty less than 500,00 RMB or a warning, this punishment shall not affect its credit rating with the customs.

Table 2: Administrative penalty amount

IV. Self-disclosure

Within the 672 cases, 184 cases (27%) were self-disclosed to the customs by companies themselves.

Pursuant to Implementing Regulations of the Customs of PRC on Administrative Penalties, when untruthful declaration affects state tax collection, company shall be imposed of penalty of 30% to 200% the tax evaded. In order to encourage enterprises’ trade compliance health check and voluntarily self-disclosure, the customs launched the Regulation of PRC on Customs Audis in 2016, which stipulates that the customs shall lighten or mitigate administrative penalties for self-disclosure enterprises.

In the 184 self-disclosure cases, 93% penalty amount is less than the penalty range stated in the Implementing Regulations of the Customs of PRC on Administrative Penalties (30% - 200% of the tax evaded). This indicates that for self-disclosure cases, the customs intend to lighten or mitigate the penalty to 15% or below of the tax evaded according to laws and regulations.

Table 3: Penalty amount in self-disclosure cases

IV. Conclusions: Health check and self-disclosure

Self-disclosure is often a result of voluntary health check. Under the automated clearance practices, the company has the legal obligation to correctly and lawfully declare the import and export goods. The customs would normally not review the declarations in advance and the customs auditor and officials from Anti-Smuggling Bureau(ASB) would rather conduct the post-clearance supervision to identify whether the company has committed customs law violations at the time of their declarations.

Trade compliance health check is desirable for the machinery, chemical and base metal (steel) industries as they face more penalty cases. Customs value, tariff code, country of origin and export control issues must be the focus of the health check.

Health check and the later self-disclosure can function as a way to resolve past issues and make future declarations compliant. However, self-disclosure has its risks. Firstly, the customs are to identify if a self-disclosure can be accepted as a self-disclosure. It would not be a self-disclosure if the same matter came known to the customs before the disclosure. Secondly, self-disclosure cannot lighten or mitigate criminal penalties. Only administrative penalty could be lightened or mitigated. Self-disclosure cannot exempt criminal investigation by the Anti-Smuggling Bureau if the disclosed case has an element of intent. Therefore, it can be a serious legal matter for health checks and self-disclosure cases.