Corporate Compliance News Insight: China Launches Compliance Guidance for Pharmaceutical and Medical Device Companies to Prevent Commercial Bribery Risks

合规亮点解读:市监总局颁布《医药企业防范商业贿赂风险合规指引》

In the sweeping national campaign against bribery in the healthcare industry in 2024, a total of 52,000 cases were filed across the country, and many senior officials and hospital management were investigated and punished. As the authority of administrative law enforcement against commercial bribery in China, the State Administration for Market Regulation ("SAMR") continues to strengthen law enforcement efforts and investigates a number of key commercial bribery cases in the healthcare industry while actively promoting the establishment of a long-term mechanism for the governance of commercial bribery in the healthcare industry. On October 11th, 2024, the SAMR published a draft of "The Compliance Guidance for the Pharmaceutical Companies in Preventing Commercial Bribery Risks" (hereinafter referred to as the "Guidance") for public comments.

After three months, the SAMR promulgated the Guidance on January 14th, 2025, aiming to address the practical needs of market players in the healthcare sectors, meanwhile endeavoring to provide practical and constructive compliance guidelines to motivate these market players in terms of optimizing compliance management for preventing commercial bribery risks. The Guidance is the first compliance guideline for preventing commercial bribery in the healthcare sector issued nationwide by a supervisory authority in China. It is of great significance and symbolizes a great advance in the supervision of anti-corruption in China. Alan Zhou and Coco Fan from the Life Sciences and Healthcare Team of Global Law Office participated in the preliminary issue collection, a series of seminars with regulators, industry associations, industry enterprises, academia, and the drafting and commenting of this Guidance.

The Guidance is divided into four chapters, comprising 49 articles.

I. Chapter 1: General Provisions:

It is made clear that the Guidance is not a compulsory law but aims to provide a reference for pharmaceutical companies and relevant third parties to carry out compliance management for preventing commercial bribery risks.

II. Chapter 2: Establishment of Compliance Management System to Prevent Commercial Bribery Risks in Pharmaceutical Companies

It draws on the PDCA management concept to provide guidance for the establishment of compliance management systems for pharmaceutical companies and advocates that the senior management of pharmaceutical companies shall (i) improve compliance awareness and (ii) support the establishment of compliance management systems. Further, pharmaceutical companies are also encouraged to establish compliance management organizations, compliance systems, and compliance operation mechanisms and to develop a compliance culture.

III. Chapter 3: Identification and Prevention of Commercial Bribery Risks for Pharmaceutical Companies

-

Scenarios Descriptions:

It is the highlight of the Guidance which includes nine scenarios as follows, which conform to the current industrial practice:

-

academic visits and communications

-

business hospitality

-

consultancy services

-

outsourcing services

-

discounts, allowances, and commissions

-

donations, sponsorships, and grant

-

free deployment of medical devices

-

clinical studies

-

pharmacies retail

Each scenario is described in detail in accordance with the same framework structure, which is divided into three parts: definitions and contents, compliance requirements, and risk identification and prevention.

It is worth noting that the Guidance is silent on medical meetings hosted by pharmaceutical companies (usually with payments of speaker fees to the engaged healthcare professionals), which are one of the most common academic promotion methods in the healthcare sector. Considering National Health Commission circulated an internal notice to hospitals in 2023, which prohibits healthcare professionals from (i) being engaged in meetings organized by pharmaceutical companies or (ii) directly receiving speaker fees paid by pharmaceutical companies, such silence in the Guidance further triggers pharmaceutical companies' concern on whether SAMR would view it lawful to directly engage healthcare professionals in the meetings directly organized by pharmaceutical companies.

-

Risk Classifications

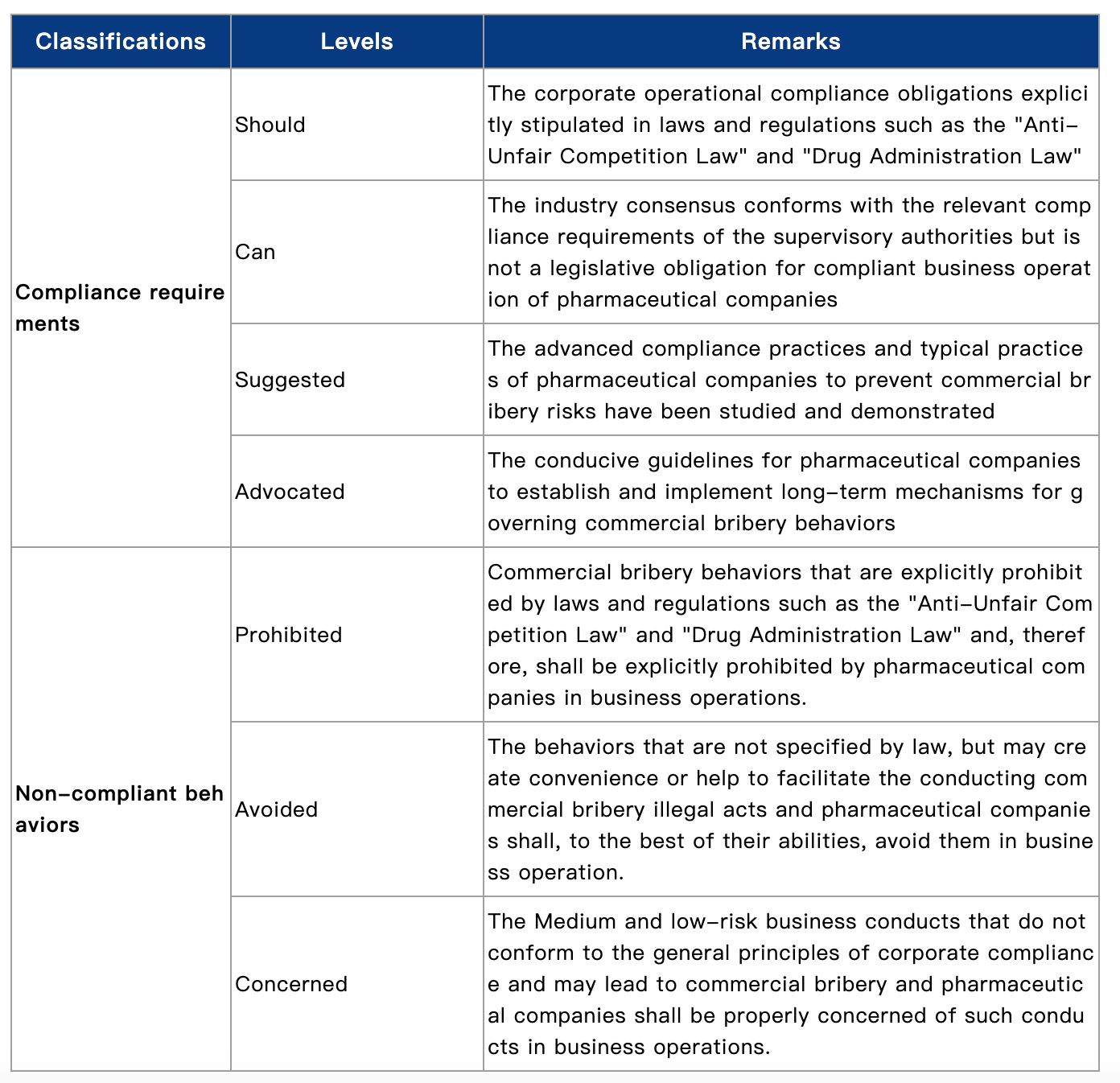

The compliance requirements of business behavior in each specific scenario are divided into four levels: "should", "can", "suggested", and "advocated". While the non-compliant behaviors that pharmaceutical companies should identify and prevent are divided into three levels: "prohibited", "avoided" and "concerned" according to the levels of illegality risks.

IV. Chapter 4: Management of Commercial Bribery Risks for Pharmaceutical Companies

It guides pharmaceutical companies to (i) effectively manage risks by improving internal control measures and cooperating with regulatory enforcement and (ii) take the initiative to report their own illegal risks in advance and cooperate with market regulation authorities in investigations in accordance with the law. It further provides the circumstances under which the administrative penalties might be lightened, mitigated, reduced, or exempted.

GLOBAL LAW OFFICE’S INSIGHTS:

The Guidance, with reference to the anti-bribery laws of foreign countries and industrial code of conduct, combined with the law enforcement practices in China, taking into account the features, business models, and management structures of pharmaceutical companies, formulated, in an innovative manner, the aforesaid nine commercial bribery risk scenarios covering the entire business, process and life cycle within the healthcare sector. For example:

-

The Guidance (i) provides both standardized guidelines as the positive list and risk points and matters for precaution as the negative list, and (ii) offers explicit, specific, and practical guidance for pharmaceutical companies in terms of commercial bribery risk management.

-

The Guidance (i) assesses risk factors in various scenarios within the business operation of pharmaceutical companies, and (ii) provides categorized guidelines corresponding to different levels of risks.

The Guidance has gone through a process of soliciting public comments before the official release by SAMR in January 2025. Highlights of changes in the Guidance on top of the previous draft for comments, among others, include the following points:

-

Grant: Compared with limiting the recipient of grants from pharmaceutical companies to medical institutions as stipulated in the draft for comments, by amending the definition of Grant, other organizations such as academic associations could also be the receipt of grants under the Guidance, which is much more in line with the actual situation of the pharmaceutical industry.

-

Academic Visit: the draft stipulates that it is prohibited to collect prescriptions under the guise of an academic visit. By removing the modifier "under the guise of an academic visit", the Guidance reiterates the zero tolerance of collecting prescriptions under all circumstances.

-

Sponsorship: Contrary to regulating only the direct sponsorship in the draft for comments, the Guidance further provides that "indirect sponsorship to medical institutions or healthcare professionals" shall also be avoided.

The Central Commission for Discipline Inspection of China Communist Party and the State Supervision Commission clearly require that in 2025, it is necessary to deepen the rectification of corruption in the pharmaceutical field, resolutely investigate and punish those who have repeatedly offered bribes to officials, and strengthen the governance of cross-border corruption. In 2025, "anti-bribery and anti-corruption" will still be the keyword in China’s pharmaceutical industry. We envisage that the Guidance would invoke healthcare market players' interest in improving their compliance management mechanism. We suggest that they (i) conduct a gap analysis between their existing compliance management system and the Guidance; (ii) prepare implementation plans to optimize their compliance management system and business operation practice based on the gap analysis results; and (iii) keep an eye on the future enforcement practice by the SAMR following the release of the Guidance.