I. Types of Inbound M&A Transactions

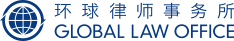

For the purpose of discussion in this article, inbound M&A transactions are roughly divided into the following types based on where each of the transferor, transferee and the target enterprise is incorporated.

1. Foreign Shareholder transfers FIE Shares to Domestic Investor

(“F→D Transaction”)

F→D Transaction in this article refers to a transaction in which a foreign shareholder transfers shares of a foreign-invested enterprise (“FIE”) to a domestic investor. F→D Transaction may result in conversion of the FIE into a domestic-invested enterprise, which is no longer subject to regulations governing FIEs.

2. Foreign Shareholder transfers FIE Shares to Foreign Investor

(“F→F Transaction”)

F→F Transaction in this article refers to a transaction in which a foreign shareholder transfers shares of an FIE to another foreign investor, either directly by transferring shares of the FIE itself ("Direct Transfer"), or indirectly through transferring shares of the offshore entity holding shares of the FIE ("Indirect Transfer").

3. M&A of Domestic Enterprises by Foreign Investors

(“D→F Transaction”)

D→F Transaction usually refers to a transaction where a foreign investor merges with or acquires a domestic-invested enterprise either by way of subscription of its new shares or acquiring its existing shares, thereby converting it into an FIE. Techincally, D→F Transaction also includes the transfer of shares of an FIE by its domestic shareholder to a foreign investor, thus increasing the foreign shareholding ratio in the FIE.

II. Common Governmental Procedures for Inbound M&A Transactions

The foreign investment administration scheme under the Foreign Investment Law of the People’s Republic of China (Effective as of January 1, 2020) (“Foreign Investment Law”) and its implementation regulations can be summarized as “registration or filing with the Administration for Market Regulation (“AMR”) + foreign investment information reporting to the commerce authorities + approval by or filing with the Development and Reform Commission (“DRC”) and\or the industry administrative authorities(if required)[1]”. The approval by or filing with the DRC or the industry administrative authorities apply only to transactions which are subject to such approval or filing pursuant to the relevant regulations, which applies equally to both domestic and foreign invested entities.

1. Negative List Administration

Pursuant to the Foreign Investment Law, the State grants national treatment to foreign investments which do not fall under the scope of negative list provided in the Special Administrative Measures (Negative List) for Foreign Investment Access (2019 Edition) (Effective as of July 30, 2019) (“Negative List”). The Negative List sets forth a total of 40 industries which are subject to special administrative measures for foreign investments. Since the commerce authorities no longer play the role of examining and approving foreign investment under the scheme of the Foreign Investment Law, such responsibility, including that of examining foreign investment within the Negative List, will be jointly shared by AMR, competent industry authorities and other applicable authorities.

2. Foreign Investment Information Reporting (“Information Reporting”)

Foreign investments outside the scope of Negative List are no longer subject to the previous approval or filing procedures with the commerce authority. They are instead subject to a simplified foreign investment information reporting requirement, which is not a pre-condition for the AMR registration. Specifically:

(1) D→F Transaction: where a foreign investor merges with or acquires the shares of a domestic-invested enterprise, it shall submit an initial foreign investment report through the enterprise registration system when conducting the AMR registration for the change of shareholders.

(2) Change of shareholder of an existing FIE (F→F or F→D): the FIE shall submit a shareholder information change report through the enterprise registration system when conducting the AMR registration for the change of shareholders.

Where an FIE is changed into a domestic-invested enterprise, once completing AMR registration for the change of shareholder of enterprises, the relevant information will be forwarded to the competent commerce authorities by the AMR, and the FIE does not need to submit FIE deregistration information report to the commerce authority separately.

(3) Foreign investments in A-share Listed Companies: Foreign-invested listed companies and companies listed on the National Equities Exchange and Quotations may report changes only when there is an accumulated change of more than 5% in shareholding ratios of foreign investors or when there is a change of control or relative control position of foreign investors.

The aforesaid foreign investment information reporting is not a prerequisite for AMR registration, and the AMR shall not examine foreign investment information reporting. Upon submission of an application for AMR registration, the applicant may continue to fill in a foreign investment information report, and the relevant information will be forwarded to the competent commerce authorities by the AMR.

3. Registration or Filing with AMR

Registration or filing with AMR used to be referred to as AIC Registration or Filing. If an inbound M&A transaction results in change of any information registered with AMR such as legal representative, registered capital and shareholders, it shall apply to its original company registration authority for a change registration.

If an inbound M&A transaction results in the amendment of the article of association or change to the directors, supervisors or managers of the target company, then such change is subject to record-filing with the original company registration authority.

4. Relevant Procedures with the DRC or the Industry Administrative Authorities

Although the examination, approval and record-filing of foreign investment access by commercial authorities have been replaced by the foreign investment information reporting system, the requirements of the DRC on project approval and record-filing have not been abolished. However, it is worth clarifying that the approval and record-filing procedures of the DRC apply equally to FIEs and domestic enterprises. An inbound M&A transaction will likely incur change of investors of a project which is subject to approval of DRC, therefore the relevant DRC may require the project company to submit the change for an approval by or reord-filing with the DRC.

Similarly, in specific industries where related regulations require that changes in the shareholders of business operators shall be approved by or filed with industrial authorities, inbound M&A transactions shall also be subject to approval or filing formalities with such industrial authorities.

III. Specific Procedure for Each Type of Inbound M&A Transactions

This sectionbriefly sets forth the specific PRC governmental procedure for each type of inbound M&A transactions. For details of the foreign exchange and tax payment matters, please refer to thenext section. This article focuses on procedures of share acquisition transaction, whereas the procedures for merger transactions can be found in Section 7 of our recent publication Foreign Investment Compliance Guidelines.

|

Type |

Change Procedures |

Foreign Exchange Formalities |

Tax Payment Formalities |

|

|

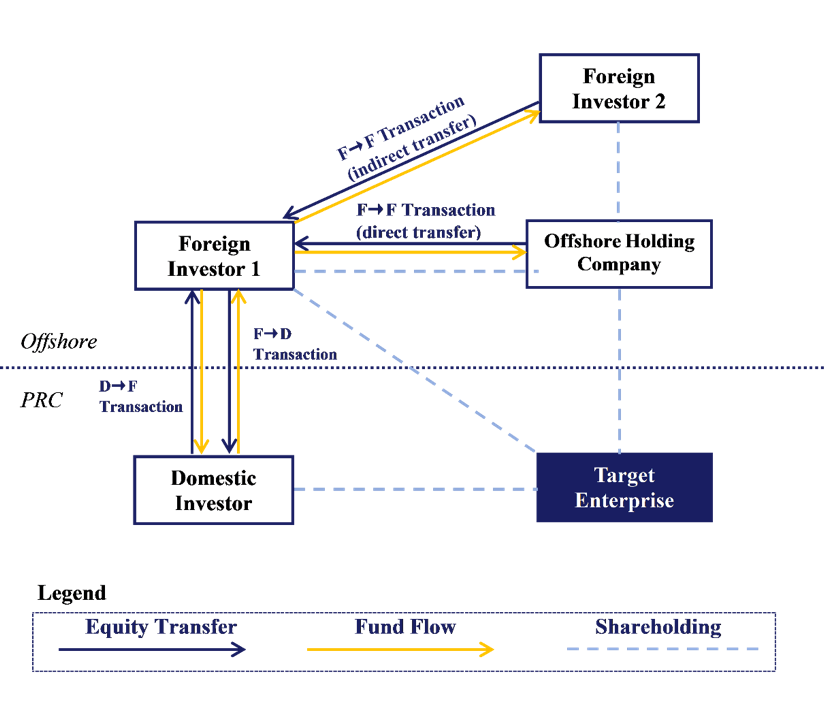

F→D Transaction

|

If the payment is to be settled in cross-border RMB, there is additional bank procedures for the seller to open specific bank account to receive the RMB. |

Payment of purchase price to the foreign transferor is conditioned upon:

1. completion of AMR registration for the change of shareholders[2];

2. completion of tax filing with respect to the transaction.

|

1. The income tax payable in an F→D Transaction shall be withheld by the domestic transferee;

2. Where the transferor is a foreign non-resident enterprise, the income tax shall be paid within seven days from the date when thepayment of purchase price is made or due. |

|

|

F→F Transaction

|

Direct Transfer

|

1. Signing transactional documents;

2. Conducting the AMR registration and the Information Reporting;

3. The Parties may decide thetiming of payment and closing as mutually agreed, which is not subject to PRC governmental procedures. |

The payment is to be made between foreign entities, which is not subject to PRC governmental procedures for the change of shareholders. |

1. In principle, the income tax payable in an F→F Transaction shall be withheld by the transferee;

2. Where the transferee fails to or is unable to perform the tax withholding obligation, the transferor may pay the tax on its own;

3. The timing requirement for the incometax payment is the same as aforesaid in F→D Transaction. |

|

Indirect Transfer

|

The Indirect Transfer discussed herein is a pure offshore transaction between foreign entities with respect to the shares of an offshore entity holding shares of the FIE, and hence generally does not involve any PRC governmental procedure. |

Same as above

|

The above taxation requirements forthe Direct Transfer also applies here if there is no reasonable commercial purpose for the Indirect Transfer arrangement.

|

|

|

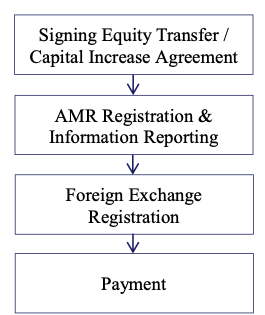

D→F Transaction [3] |

share transfer

|

|

Foreign exchange registration and payment may be completed only after the share transfer AMR registration is completed[4]; |

Where the transferor is a domestic resident individual, the transferee shall withhold individual income tax at the rate of 20%.

Where the transferor is a domestic resident enterprise, the proceeds from the share transfer shall be included in the transferor's income for the current year's settlement and payment, and need not be withheld by the transferee. |

|

subscription of new |

Same as above. |

Same as above. |

Usually no tax filing or payment requirement is involved with respect to subscription of new shares,except in cases where a foreign investor uses the profits received froma PRC domestic resident to pay the subscription price in an amount exceeding US $50,000, tax filing shall be completed prior to the payment. |

|

IV. Certain Foreign Exchange and Taxation Considerations

1. “Share Transfer Before Payment” Issue Arising from Foreign Exchange Formalities

1.1. F→D Transaction

In principle, there is no legal barrier for foreign investors to withdraw their investment and remit their investment funds overseas from China.It is worthnoting thoughthat due to certain procedural requirements with respect to cross-border payment as a matter of practice, it might make sense to put in place certain contractual arrangements in order to reduce potential risks.

According to relevant regulations, in a F→D Transaction, the AMR registration for change of shareholders shall be handled before the formalities for change of foreign exchange registration and payment of purchase price overseas, which means that there is a theoretical risk that the transferor is unable to receive transfer price after the transferred shares are registered in the name of the transferee .

To mitigate this potential risk, the parties would usually provide in transaction documents, among others 1) the transferee shall pay deposits or provide a performance guarantee after execution of the share purchase agreement and prior to the AMR registration to secure the full payment of purchase price; 2) the purchase price should be deposited into an escrow account which is subject to the supervision of the transferor; 3) the transferee shall pledge the target shares to the transferor immediately following theAMR registration for change of shareholders to secure the payment obligation of the transferee; and 4) the physical delivery of the target enterprise and the transfer of actual control (such as hand over of company seals,important permits and licenses, and transfer of operational and management control, etc.) will not happen until the transferor’s receipt of the purchase price.

1.2. D→F Transaction

Similar issue also exists in D→F Transactionin which payment by foreign investor is also subject to completion of the AMR registration for change of shareholders. Therefore, in a D→F Transaction, the domestic transferor may face the same theoretical risk that they may not receive the purchase price after the target shares are registered in the name of the transferee already. To mitigate the risk, the transaction parties may reach similar arrangements as set forth in the aforesaid F→D Transaction section.

2. Income Tax with respect to the Transactions

2.1. PRC domestic resident[5] as the transferor

If the transferor is a domestic resident enterprise, the transferor shall pay enterprise income tax on its incomes derived from the share transfer transaction at the rate of 25%. The income derived from the transaction shall be included in the transferor’s annual enterprise income tax return which is expected to be submitted to the tax authority by the end of May in the next year, following which the payable tax shall be settled or refunded on a consolidated basis.

Where the transferor is a domestic resident individual, he/she is subject toindividual income tax with respect to the proceeds derived from the share transfer transaction at a rate of 20%, which shall be declared and withheld by the transferee as the withholding agent.

2.2. Foreign non-resident as the transferor

A. Foreign non-resident enterprise as the transferor

a) Direct Transfer

In a transaction where a foreign non-resident enterprise directly transfers the shares of a PRC domestic FIE, regardless of whether the transferee is a domestic or foreign entity, the transferor is required to pay 10% enterprise income tax on the taxable income derived from the transaction. If the transferee is a PRC domestic entity, the tax shall be withheld by the transferee. If the transferee is a foreign non-resident entity, the tax shall be withheld and paid by the transferee in principle;However, if the transferee fails to or is unable to fulfill the withholding obligation, the transferor may pay the tax on its own.

b) Indirect Transfer

In an Indirect Transfer, where the transferor is unable to prove to the tax authorities the reasonable commercial purpose of the Indirect Transfer arrangement, then the transferor is also subject to the PRCincome tax at a rate of 10% as in a Direct Transfer transaction pursuant to the Announcement on Several Issues Relating to Enterprise Income Tax on Indirect Transfer of Properties by Non-resident Enterprises (Effective as of February 3, 2015).

It’s worth noting that in an F→F Transaction, either Direct Transfer or Indirect Transfer, the transferee shall be the withholding agent according to PRC tax regulations. In practice, however, due to various reasons such as the transferor’s willingness and closing schedule, the transferee may be unable or otherwise fails to withhold the transferor’s income tax prior to the payment of the purchase price and closing. Under thecircumstance where the transferee has paid the full amount of thepurchase price before paying up applicable PRC income tax, there is a theoretical risk that ifthe transferor later on fails to pay the tax after closing, the transferee would also be subject to administrative sanctions for non-performance of its tax obligations. As such, from the perspective of protecting the transferee from such legal exposures, it may be worth providing in the transaction documents that either the transferee shall withhold PRC income tax for the transferor prior to the payment of purchase price, or a mutually agreed portion of the purchase price will be set aside in an escrow account for the sole purpose of paying the transferor's PRC income tax. Meanwhile, the transaction documents shall provide that the transferor shall indemnify the transferee from any adverse consequences arising from transferor’s non-compliance with any applicable tax rules and regulations in respect of the transaction including its violation of tax filing or payment obligations.

B. Foreign non-resident individual as the transferor

According to the Individual Income Tax Law of the People's Republic of China (Effective as of January 1, 2019) (“Individual Income Tax Law”), individual income earned within China by non-resident individuals shall also be subject to PRC individual income tax. Pursuant to the Measures for the Administration of Individual Income Tax on Share Transfer Income (for Trial Implementation) (Effective as of January 1, 2015), the transferor shall be the taxpayer for individual income tax on income derived froma share transfer transaction and the transferee shall be the withholding agent. Therefore, if a foreign non-resident individual transfers his/her shares in domestic resident enterprises, the transferee, as the withholding agent, shall declare and withhold 20% of individual income tax with respect to the share transfer proceeds.

A controversial issue in practice is whether a foreign non-resident individual shall pay PRC individual income tax if he/she indirectly transfers the shares of domestic resident enterprises in an offshore Indirect Transfer transaction. Article 8 of the Individual Income Tax Law provides grounds of anti-tax avoidance for tax authorities: where individuals “obtain improper tax benefits by implementing other arrangements without reasonable commercial purposes", tax authorities have the right to make tax adjustment or supplementary collection as appropriate. However, in practice, the criteria of “reasonable commercial purposes” remains subject to case-by-case interpretation due to the lack of uniform rules.

References:

[1] For detailed analysis, please refer to the Foreign Investment Compliance Guidelines issued by our firm in January 2020.

[2]Please refer to sub-section 1.1 of the next section for common risk mitigation measures.

[3] Before the Provisions on the Merger and Acquisition of Domestic Enterprises by Foreign Investors is abolished or revised, it remains to be seen whether the provisions on payment timing and etc. thereof should be implemented.

[4] The common safeguard measures are described in Section 1.1 of the “Certain Foreign Exchange and Taxation Considerations” in Chapter IV below.

[5] This article uses “domestic residents” and “foreign non-residents” to describe tax issues for the convenience of understanding, while the definitions of “residents” and “non-residents” in tax laws do not fully correspond to “domestic” and “foreign”. For tax analysis in specific cases, please seek the advice of a professional consultant.