Preamble

On December 29, 2023, the Standing Committee of the Fourteenth National People’s Congress of the People’s Republic of China voted to adopt the newly amended Company Law of the People’s Republic of China (the “New Company Law”) during its seventh session. The New Company Law will come into effect on July 1, 2024. The New Company Law’s revision and improvement of the registered capital system has attracted extensive attention and market discussions.

The New Company Law stipulates that, for a limited liability company, the subscribed capital shall be fully paid by its shareholders within five years from the date of the company’s establishment according to the company’s articles of association[2]. For companies already registered for establishment before the New Company Law enters into force, if the capital contribution period exceeds the period stipulated in the New Company Law, the period shall be gradually adjusted to be within the period as stipulated in the New Company Law, unless otherwise provided for by any laws, administrative regulations, or the State Council; if a company’s capital contribution period or amount is obviously abnormal, the company registration authority may, in accordance with the law, require such company to make adjustments in due course[3]. In addition, the New Company Law explicitly requires that the specific implementation measures shall be otherwise provided for by the State Council[4].

In order to implement the above provisions of the New Company Law, on February 6, 2024, the State Administration for Market Regulation (“SAMR”) sought public comments on the Provisions of the State Council on Implementing the Registered Capital Registration and Management System under the Company Law of the People’s Republic of China (Draft for Comment) (the “Draft for Comment”). The deadline for public feedback on the Draft for Comment is March 5, 2024. The Draft for Comment provides different regulations for the registration and management of registered capital for newly established companies and existing companies, covering capital contribution period, standard to determine abnormalities, capital reduction procedures, exceptions and requirements for disclosure of information, which addresses the topical issues in the market. This article will summarize the main contents of the Draft for Comment for the reference of readers.

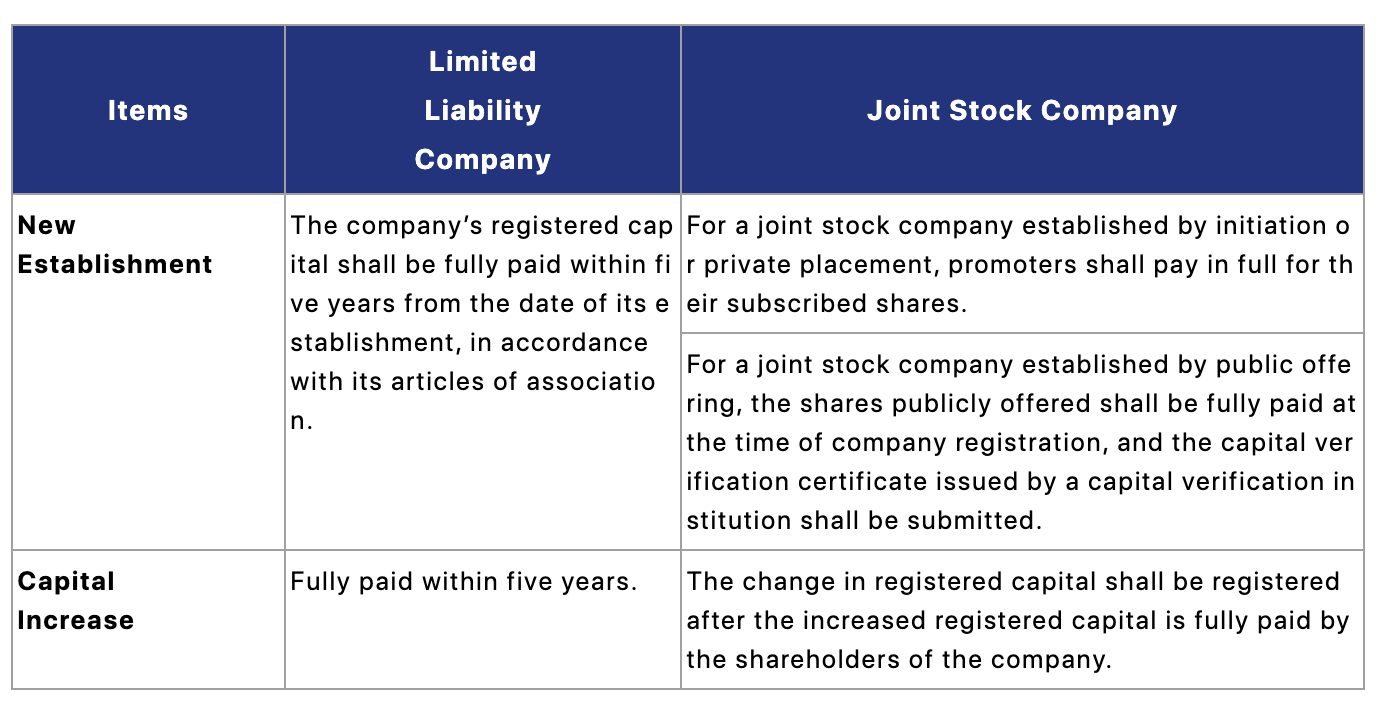

I. Capital Contribution Period for Newly Established Companies and Capital Increase

Article 2 of the Draft for Comment reiterates and refines the rules on capital contribution period for newly established companies and capital increase, as stipulated in the New Company Law, as follows[5]:

The Draft for Comment also stipulates that limited liability companies and joint stock companies established by initiation or private placement are not required to submit the capital verification certificate issued by a capital verification institution when applying for company registration[6]. However, joint stock companies established by public offering are required to submit a capital verification certificate from a capital verification institution when applying for company registration.

In addition, the Draft for Comment has not stipulated whether a capital verification certificate is required for the capital increase of a company. Given the above provisions on newly established companies and the evolution of the requirements for capital verification under the Chinese company law, we understand that it should be interpreted that a capital verification certificate is not required for the capital increase of a company. However, readers should note that even if it is not necessary to submit the capital verification certificate for the capital increase of a company, the company should still upload the register of shareholders, financial statements and other relevant materials indicating the paid-in capital by shareholders through the National Enterprise Credit Information Publicity System[7]. We also noticed that the Draft for Comment did not specify the starting date for the 5-year time limit for the capital increase of a limited liability company, and we hope that this will be enlightened in the officially adopted version. We speculate that the aforementioned starting date will be the date on which the shareholders resolution for approving the capital increase is passed.

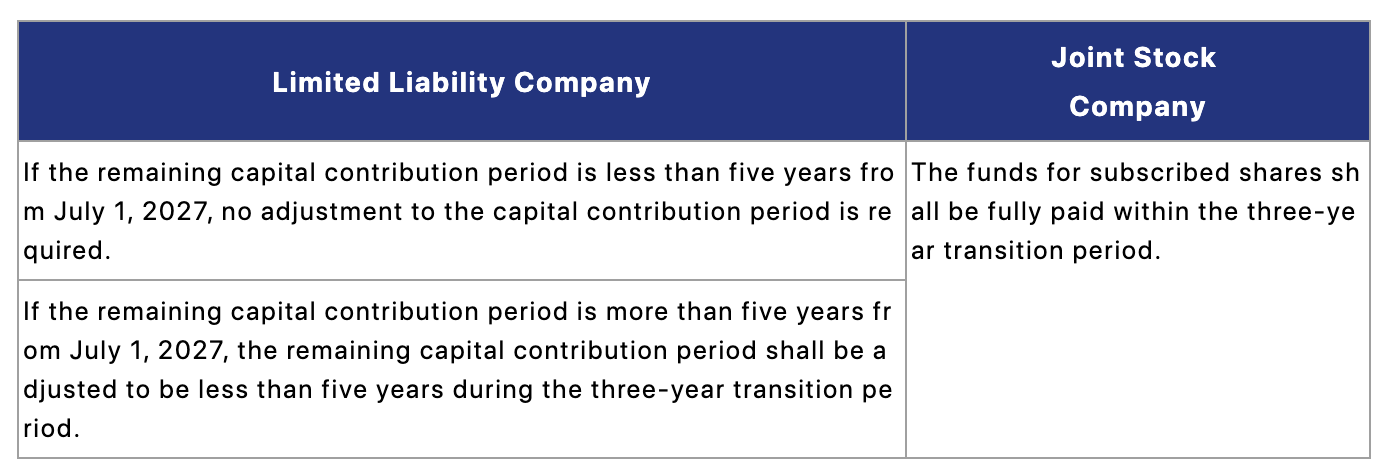

II. Three-Year Transition Period for Existing Companies to Proactively Adjust Capital Contribution Period

Article 266 of the New Company Law, which pertains to the requirement for existing companies to comply with the new capital contribution period, has sparked extensive discussions on whether the New Company Law should have retroactive effect and how to balance the interests of the company, the interest of its creditors, and the interest of its shareholders in making the capital contribution within the capital contribution period agreed by those shareholders at will and as stipulated in the company’s articles of association. Article 266 of the New Company Law provides two methods for adjusting the capital contribution period for the registered capital of existing companies: (1) proactive adjustment: gradually adjust to the capital contribution period as stipulated by the New Company Law; (2) passive adjustment: for contributions with obvious abnormalities in terms of the capital contribution period or amount, the company registration authority may require the company to adjust in due course. However, the New Company Law has not clarified what constitutes “gradually” or an “obvious abnormality.”

Article 3 of the Draft for Comment explicitly establishes a three-year transition period (i.e., from July 1, 2024 to June 30, 2027) on the basis of Article 266 of the New Company Law, and it details how limited liability companies and joint stock companies should adjust the capital contribution period during this transition period, as follows[8]:

According to the above provisions, a limited liability company that needs to adjust its capital contribution period can theoretically benefit from a capital contribution period of nearly 8 years after the New Company Law comes into effect, while the subscribed shares of a joint stock company can be fully paid within nearly 3 years after the new Company Law comes into effect. This provides ample adjustment time for existing companies to adapt to the new requirements of the registered capital system, while ensuring the stability and continuity of market entities.

For existing limited liability companies that will not proactively adjust the capital contribution period during the transition period, the Draft for Comment stipulates that the company registration authority can demand them to adjust the capital contribution period within 90 days, with such adjusted capital contribution period not exceeding five years from July 1, 2027[9].

III. Method for Determining “Obvious Abnormalities” in Capital Contribution Period and Amount

As mentioned above, Article 266 of the New Company Law provides the passive adjustment method for the registered capital of existing companies, i.e., the company registration authority can demand timely adjustments for obvious abnormalities in their capital contribution periods or amount. However, the New Company Law has not clarified what constitutes an “obvious abnormality”.

Article 7 of the Draft for Comment stipulates that for a company established before July 1, 2024, with its capital contribution period exceeding thirty years or its capital contribution amount exceeding RMB 1 billion, the company registration authority may assess the authenticity of its registered capital based on a combination of factors such as its shareholders’ capital contribution capabilities, main business and asset scale. The evaluation methods include: (1) requiring the company to provide explanations; (2) organizing professional institutions in the industry to conduct evaluations; and (3) consulting with relevant authorities for assessment. If it is determined that there are indeed obvious abnormalities in the company’s capital contribution period or amount, subject to the approval of the provincial-level administration for market regulation, such company may be required to adjust its capital contribution period and amount within six months. The adjusted capital contribution period shall not exceed five years, starting from July 1, 2027.

The Draft for Comment has not specified the starting date for calculating the “capital contribution period exceeding thirty years”, and we speculate that such period might start from the establishment date of the company. If that is the case, we understand that the company registration authority may also need to further illustrate and assess the remaining capital contribution period of the company from July 1, 2027 in connection with the provisions of paragraph 2 of Article 3 of the Draft for Comment. In addition, the provisions of the abovementioned Article 7 has not specified the date from which the company registration authority initiates the abovementioned assessment. Based on the result that the company registration authority may demand the company to adjust the capital contribution period to be within 5 years from July 1, 2027, as per Article 7 of the Draft for Comment, we understand that the assessment should be conducted within the three-year transition period. However, we noticed that the final adjustment result seems to be applicable for limited liability companies rather than joint stock companies. This is because, as stated previously, the Draft for Comment stipulates that the subscribed shares of an existing joint stock company shall be fully paid within the three-year transition period. Lastly, it seems that the adjustment result of the capital contribution amount is missing in Article 7, which means it’s unclear whether the company registration authority will require an existing company with capital contribution amount more than RMB 1 billion to reduce such amount, or to what extent that reduction may be. We hope that the above questions will be answered in the officially adopted regulation.

In addition, according to Article 9 of the Draft for Comment, if a limited liability company to be established has obviously inflated registered capital, is contrary to common sense and the characteristics of the industry, is obviously incapable of actual capital payment, or otherwise violates the principle of authenticity, or violates any laws, administrative regulations, or decisions of the State Council, the company registration authority shall not permit such company’s registration. We understand that, in practice, without further detailed guidelines, it is difficult for the officials of the company registration authority to have a precise, comprehensive and objective judgment on what constitutes “obviously inflated” registered capital or “contrary to common sense and the characteristics of the industry” for companies in different industries. It is also difficult for such officials to verify or make final judgment on whether the shareholders are “obviously incapable of actual capital payment.” This discretionary standard needs to be further clarified.

IV. Exceptions for Certain Companies

While emphasizing that the registered capital should be fully paid within a certain period of time, the Draft for Comment also takes into account the actual needs of certain types of companies and the cost of administrative management of the government. It contains more reasonable and flexible provisions to adapt to the developmental needs and actual circumstances of different companies. The Draft for Comment explicitly outlines the following two circumstances under which the compliance with the regulations relating to capital contribution period may be either exempted or practically excused due to difficulties in complying with such regulations in reality:

One is, companies established before the implementation of the New Company Law that undertake significant national strategic tasks, are related to national economy and people’s livelihoods, or are involved in national security or major public interests may, with the consent of the competent department of the State Council or the government at or above the provincial level, make capital contributions in accordance with the original capital contribution period[10]. This provision falls under the circumstances stipulated in Article 266 of the New Company Law as “otherwise provided for by laws, administrative regulations or the State Council.” This exception not only assists the regular operation and development of those companies, but also contributes to the realization of national interests and public interests. In addition, the Draft for Comment also makes it clear that the aforementioned companies include various types of companies such as private companies, foreign-invested companies, and state-owned companies[11] rather than being limited to specific types of companies (e.g., state-owned companies).

The other is, if a company established before the implementation of the New Company Law has its business license revoked, is ordered to close down or is cancelled, resulting in the company being unable to adjust its registered capital, or if the company cannot be contacted through its registered address or place of business and is included in the list of abnormal operation, the company registration authority shall manage the company in a separate register, and shall make a special annotation and public announcement in the National Enterprise Credit Information Publicity System[12]. These provisions take into account the impracticality for the company under the above circumstances to proactively adjust the capital contribution period according to the provisions of the New Company Law and the Draft for Comment, granting the company registration authority the power to manage the company in a separate register, and make a special annotation and public announcement in the National Enterprise Credit Information Publicity System, thus striking a balance between the cost of administrative management and the prevention of social risks.

V. New Simplified Capital Reduction Procedures

After the provisions on the capital contribution period of the New Company Law come into effect, the demand for company capital reduction can be expected to surge in a short period of time. In response to market demand and in an effort to enhance the level of governmental services, the Draft for Comment establishes simpler procedures for the existing companies to register change for capital reduction, in addition to the capital reduction procedures outlined in Articles 224 and 225 of the New Company Law. Specifically, a company that meets the following conditions can make a public announcement through the National Enterprise Credit Information Publicity System for 20 days, and provided that its creditors do not raise any objections during the announcement period, the company can apply for registration of change in registered capital with the application form and the undertaking letter[13]:

(1) The company is established prior to the implementation of the New Company Law;

(2) The company applies for a reduction of registered capital during the transition period without reducing paid-in capital contribution;

(3) There are no outstanding debts or debts that are significantly lower than the company’s paid-in registered capital;

(4) All shareholders undertake to be jointly and severally liable for the company’s debts before the capital reduction within their original subscribed capital range; and

(5) All directors undertake not to impair the company’s debt repayment ability and continuing operating capabilities.

The above simplified procedures aim to provide companies with a more convenient and efficient method of reducing capital while safeguarding the interests of their creditors, and further secure orderly capital reduction and smooth transition of market entities during the transitional period. Of course, we also note that the “simplified” capital reduction procedures require the fulfillment of the above conditions (1) to (5). These conditions impose certain requirements on the consistent relationship of the company’s shareholders and the smooth voting at the shareholders’ or board meeting. In particular, it is necessary for the company registration authority to provide clearer guidelines on how to determine a company’s debt repayment ability and continuing operating capabilities.

VI. Specific Requirements for Disclosure of Information

In order to improve the transparency and accuracy of a company’s capital contribution information, provide risk alerts for the operations of market entities and encourage the shareholders’ capital contribution through social monitoring, the Draft for Comment strengthens the information disclosure requirements for companies and the power of the company registration authority to disclose the information, as follows:

(1) Within 20 working days from the date of formation of certain information such as the subscribed and paid-in capital, the method of capital contribution, the date of capital contribution, the number of shares subscribed by the promoters, as well as changes in equity interest held by or shares of the shareholders or promoters of the company, the company shall disclose such information to the public through the National Enterprise Credit Information Publicity System[14];

(2) If an existing company has its business license revoked, is ordered to close down or is cancelled, resulting in the company being unable to adjust its registered capital, or if the company cannot be contacted through its registered address or place of business and is included in the list of abnormal operation, the company registration authority shall make a special annotation and public announcement in the National Enterprise Credit Information Publicity System[15]; and

(3) If a company fails to adjust its capital contribution period or amount in accordance with Article 6 and Article 7 of the Draft for Comment, the company registration authority shall make a special annotation and public announcement in the National Enterprise Credit Information Publicity System[16].

VII. Conclusion

The Draft for Comment focuses on the implementation of the “3+5” adjustment arrangement for existing companies, and combines with the determination of abnormal companies in terms of the period and amount of capital contribution, exceptions, the capital reduction procedures, information disclosure requirements and other requirements, in order to stabilize market expectations, achieve orderly transition between the old and the new registered capital registration systems, create an trustworthy and orderly business environment, and promote the sustainable development of various types of business entities. However, as supporting regulations for the New Company Law, the Draft for Comment still contains some ambiguous provisions, for example, the standard for determining “obviously inflated registered capital, contrary to common sense and the characteristics of the industry, obviously incapable of actual capital payment” has not yet been clarified. We hope that the relevant departments will further clarify and provide details of such standards in the forthcoming regulations to be implemented, which will provide clear guidance and establish standards for market entities and promote the healthy development of the market.

[1] Sarah Wang and Victoria Liao (intern) also contributed to the preparation of this article.

[2] Article 47 of the New Company Law.

[3] Article 266 of the New Company Law.

[4] Article 266 of the New Company Law.

[5] Article 2 of the Draft for Comment.

[6] Article 2 of the Draft for Comment.

[7] Article 10 of the Draft for Comment.

[8] Article 3 of the Draft for Comment.

[9] Article 6 of the Draft for Comment.

[10] Article 8 of the Draft for Comment.

[11] Article 8 of the Draft for Comment.

[12] Article 11 of the Draft for Comment.

[13] Article 5 of the Draft for Comment.

[14] Article 10 of the Draft for Comment.

[15] Article 11 of the Draft for Comment.

[16] Article 14 of the Draft for Comment.